Forecasting or a forecast demand has become a compulsory analysis to any hotelier, as far as it allows us to see how future months are evolving in comparison with the exact same date of the previous year. By doing this, we can anticipate any future deviations and be able to implement strategies in time.

Hereunder, we will detail a practical forecasting case of July, being now in April. To see what is exactly happening in July, we will choose the monthly analysis (quite general), although we could also carry on a weekly or daily analysis (much more elaborated). Let’s get down to it!

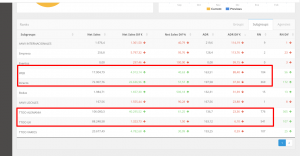

By studying the dashboard of July (we will analyse the stays that have been already booked for July 2017 by April, 10th, and we will compare them to the stays that we had for July 2016 by April 10th 2016) we can get the following information:

1 – Revenue: We can see that the forecast is quite good; we have an increase of the 56%.

2 – Number of Bookings: Excessive demand increasing, a 193% more than the last year.

3 – ADR: 13% of decrease. (In the following sections, we will analyse where we are losing the Average Daily Rate so we can take suitable measures)

4 – Occupancy: 14,83% more

5 – Roomnights: Increase of the 79%

6 – Cancellations: There is almost a 92% more than the previous year. We must deeply study why this is happening.

7 – RevPar: Fundamental KPI; it indicates 19,54 more. Really good data!

8 – Average daily rate: 47% less than the previous year.

9 – Roomnights: 2,65 less than last year. Taking into account that in July there are no groups that affect the average stay, we must analyse why ‘roomnights’ has decreased almost from 7 nights to 4.

Why do we lose ADR (Average Daily Rate)?

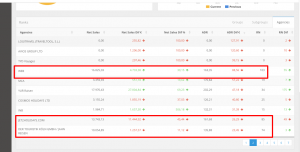

As we can see in the next picture, those sectors which have lost more ADR but have generated more roomnights are: German and UK Tour Operators, directs and the official web.

This loss of average rate is due to an Early Booking offer activated 5 months before in the sectors above mentioned. In all of them we can see that this offer has generated more revenue without sacrificing ADR. However, although UK Tour Operators have sold more roomnights than last year, its revenue are 1,5% less.

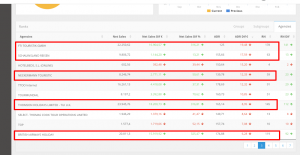

By taking a closer look, we will not only see which are the sectors that had lost ADR, but we will also see the specific agencies. Once again, we organize the table by ADR loss and we will focus only in those agencies that had generated more than 50 roomnights.

As shown, within UK Tour Operators we can find: Jet2holidays, Thomson Holidays and British Airways. Within the Germans one, we can see: Dertouristik, FTI Touristik, Schauinsland Reisen and Neckerman.

All agencies have generated more revenue and more roomnights, which is positively translated since the Early Booking offer has achieved its goal in all of them; with the exception of Jet2holidays and Dertouristik.

In a deeper analysis, we could also see if the loss of average price has been a result of standard rooms sales and/or of the most economical board type or if it is due to other reasons. We will deal with this in a future post 🙂

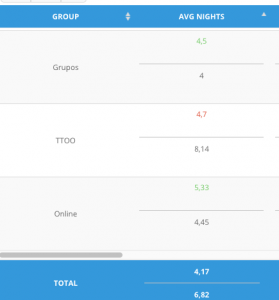

Why does the hotel Average Stay decrease from 6,82 to 4,17 nights?

If we check ‘Advance Stats’, we see that in the online sector, the average stay has increased from 4,45 to 5,53 nights; so, this sector is no responsible of the loss.

Actually, the loss is concentrated on the Tour Operators sector (where the Early Booking has had more impact), reducing the average stay to almost a 50% (from 8,14 roomnights last year to 4,7 this one).

Having this in mind, we will exclusively analyse Tour Operation:

A. Nationalities

Paying attention to nationalities, we see that a very important factor in the decrease of roomnights has been the German market, which grew by 20% in booking numbers (last year was a 42% of the total, and this year represents a 64,78%). Indeed, in this hotel, the average stay of this market is considerably lower to the rest, as we can see in the following picture:

This means, if the German market increases significantly, the hotel average stay might be affected.

B. Rooms

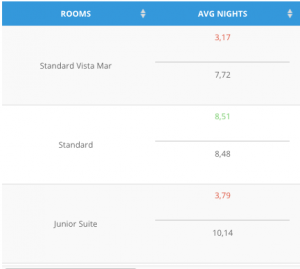

If we analyse the Tour Operation room sales, we identify that it is in Standard Sea View Room and in the Junior Suite that the average stay has decreased. However, we can see how the stay in the Standard Room has been practically the same throughout the whole month.

Conclusions:

1 – The demand on July has been reactivated, partly thanks to the attractive Early Booking offer that we implemented 5 months ago. So, with the current demand, it is time to limit the offer and focus on possible strategies to increase ADR.

2 – We should immediately restrict this Early Booking offer to Jet2holidays and Dertouristik, for they did not answer as expected.

3 – We should now study possible actions that would help to increase the Tour Operation average stay, specifically in the German market and in these two rooms: Standard See View and Junior Suite.

Clearly, this is a very superficial analysis of a complete month. In order to do a deeper study, we must focus on specific weeks or days.

CEO y Fundador de Metrily y apasionado del revenue management.